In the last few years, digital transformation has innovated industries all over the globe, and the same is being experienced in accounting in Dubai. In the UAE businesses demanding efficiency, transparency, and compliance, the employment of technology-driven accounting solutions has turned into a requirement.

To stay competitive and compliant with local laws and regulations, a start-up in Dubai’s technology sector or an SME in a UAE free zone must rely on digital accounting solutions.

In this article, we will discuss how digital innovation is affecting accounting & bookkeeping, VAT compliance, audit coordination, financial controls, and related accounting services across Dubai and the UAE.

Embracing Technology-Driven Accounting in UAE

The Smart City vision is making Dubai go through fast business operations requiring innovation in accounting. We can say that manual spreadsheets are now being replaced by cloud-based platforms, AI tools, and automation, which provide real-time information, safe storage, and a simplified reporting process.

Such well-known solutions like QuickBooks, Xero, and Zoho Books are broadly adopted by Dubai companies for bookkeeping, taxation and financial services. These tools can access accurate data any time which makes someone able to make quick decisions in a competitive market.

Cloud Accounting and Digital Transformation in Dubai

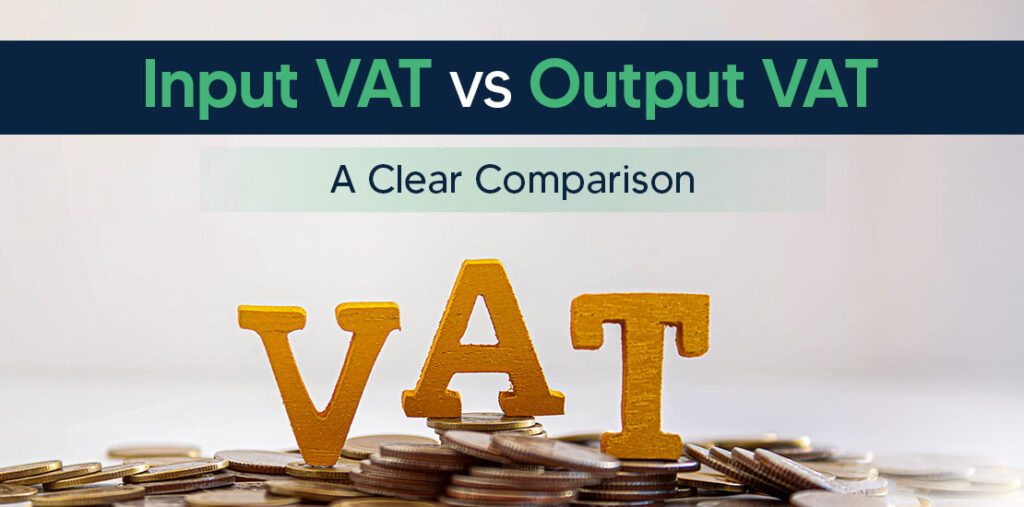

Automation and cloud-based accounting are some of the essential changes made in the accounting industry of UAE. These technologies help in minimizing manual errors, save time, and improve cash flow visibility. For example, automated VAT return filing which is one of the stringent taxation policies in UAE, has become a basic requirement.

Businesses are increasingly turning to accounting & bookkeeping firms in Dubai that specialize in automation, promoting smooth audit preparation & coordination while ensuring constant financial monitoring.

On another hand, automation tools also play a very important role in payroll management, expense tracking, and regulatory compliance. It also helps the finance team to spend more time on planning rather than performing repetitive actions, as it reduces the need for manual effort.

The Importance of Regulatory Compliance in UAE

As VAT in UAE is being introduced, it is more crucial than ever to keep accurate financial records and follow regulatory compliance. Companies must maintain digital records, adhere to FTA regulations, and be ready for tax audits.

Non-compliance may lead to serious penalties and this is the reason why a number of companies have integrated the outsourced accounting services in Dubai. Digital accounting platforms help ensure that all tax submissions are accurate and timely.

Audit preparation & coordination is also enhanced in these platforms as it would generate audit reports needed during audit. Businesses in industries with dynamic regulatory environments, such as real estate, hospitality, and banking, substantially benefit from tech-enabled risk management and taxation services.

Digital Tools for AML & Financial Controls in Dubai

Businesses must now install AML (Anti-Money Laundering) controls and internal auditing procedures due to increasing financial scrutiny by UAE regulators. The sophisticated accounting systems provide the tools that support AML & financial control whereby businesses identify any doubtful transaction with ease, observe the movement of money, and keep records.

The financial sector in Dubai, especially, has adopted the tools that integrate compliance, reporting, and alert systems for AML. As part of the UAE’s goal to improve international economic connections, maintaining clean and traceable financial activities has been a top concern.

Hence, modern accounting firms in Dubai provide both compliance consulting and technology-driven accounting solutions that address AML risks effectively.

Small and Medium Enterprises (SMEs) in Dubai

The concept of Digital transformation isn’t limited to large corporations. Digital technologies are increasingly being used by SMEs in Dubai to effectively compete in a tech-driven economy. These companies benefit from:

- Affordable accounting & bookkeeping solutions

- Easy access to taxation services in Dubai

- Faster audit preparation & coordination

- Enhanced visibility into financial activities

Most of the SME owners used to do this through obsolete ways. They can now handle cash flow, tax returns, and compliance all in one place with the use of cloud software and expert digital assistance, guaranteeing long-term viability and expansion.

Role of Government in Driving Digital Accounting in UAE

The efforts provided by the UAE government, such as Smart Dubai or the Dubai Paperless Strategy, are speeding up transformation towards completely digital business environments. These initiatives support sustainability, efficiency, and transparency, they are three key factors that are revolutionizing the field of accounting.

As the vision indicates, businesses are urged to digitalize their accounting and bookkeeping practices, embrace the e-invoicing culture, and implement cloud platforms that fall within the standards, which have been approved by the government.

Additionally, this drive guarantees more precise and organized taxation services in UAE, lowering the chance of fines and audits while promoting general financial stability.

Choosing the Right Digital Accounting Partner in Dubai

The best way to survive in the competitive and quickly emerging financial world of Dubai is working with accountants that provide technology-driven solutions and are aware of the UAE’s legal and regulatory environment.

- Support from experts in regulatory compliance

- VAT-ready systems and automated reporting

- End-to-end support in audit preparation & coordination

- Built-in AML & financial controls

When it comes to running a business and finding a vendor, Dos Hermanos is one of the best accounting industry in Dubai for companies looking for a reliable partner. Their competent team is proficient in regional experience and integrated with the latest digital tools that deliver smooth compliance, precise reporting, and scalable financial systems.

AI and Automation in Dubai’s Accounting Industry

The current trend of accounting in Dubai is undergoing a revolution due to AI as activities such as data entry, invoicing and reporting are becoming automated. The trend toward smart accounting is evident, as 71% of tax experts support the usage of Generative AI.

Accurate financial forecasting, real-time insights, and predictive analysis are made possible by sophisticated instruments. Simultaneously blockchain technology is also improving security, compliance, and transparency.

Dubai as a leader in digital innovation, enables companies to gain a competitive advantage, enhance efficiency and scalable expansion through early adoption of AI and automation.

Final Thoughts

The accounting industry in Dubai is a strategic requirement rather than just a trend. Automation and technology nowadays are essential from accounting & bookkeeping to regulatory compliance and AML controls for businesses to be compliant and flexible.

By investing in modern tools and expert services in a market that tends to move quickly, success can be guaranteed, in addition to lowering human error and saving time along the way. Whether you are looking for taxation services, getting ready for audits, or investigating cloud accounting possibilities, now is the time to go digital.